QY Research says Income Protection Insurance Market to Reach US$40726.64 million by 2026

Industry: Healthcare

Premium market research on Global Income Protection Insurance Market Analysis and Forecast 2020-2026 with Industry Growth Opportunities, Size, Competition and Regions.

Los Angeles, CA (PRUnderground) February 25th, 2020

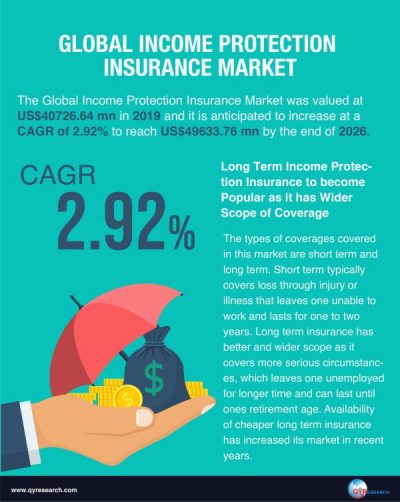

In a recent report by QY Research, titled, “Global Income Protection Insurance Market Report, History and Forecast 2015-2026” analysts have provided an in-depth understanding of the growing income protection insurance market. The global income protection insurance market was valued at US$40726.64 mn in 2019 and it is anticipated to increase at a CAGR of 2.92% to reach US$49633.76 mn by the end of 2026.

Get PDF sample copy of the report at: https://www.qyresearch.com/sample-form/form/1454734/global-income-protection-insurance-market

Income protection insurance is a type of a policy that insures against income loss as a result of illness, accident, or unemployment. It promises a tax free income, which will be given to a person until he or she is able to work or retire. Now a days, people are leaning towards passive income and investing money to generate wealth as job security remains questionable. Moreover, unpreceded escalation of medical and education costs has also led to demand for income protection insurances. In this case income protection insurance can be used as replacement income to satisfy and complete the basic financial requirements. All of these factors are projected to drive the global market for income protection insurance.

Growing Health Related Issues in Women to Augment Income Protection Insurance Market

According to the studies, women the key buyers of income protection insurance and it is more expensive for women than men. As women are more likely to have higher health related concerns and early retirement age, women are expected to be the key end users.

Long Term Income Protection Insurance to become Popular as it has Wider Scope of Coverage

The types of coverages covered in this market are short term and long term. Short term typically covers loss through injury or illness that leaves one unable to work and lasts for one to two years. Long term insurance has better and wider scope as it covers more serious circumstances, which leaves one unemployed for longer time and can last until ones retirement age. Availability of cheaper long term insurance has increased its market in recent years.

Australia to drive the Income Protection Insurance Market due to Better Awareness

Australia is expected to drive the global income protection insurance market due to higher consumer awareness. Also, high rate of risk in unemployment in the country is expected to drive growth.

Global Income Protection Insurance Market Competitive Landscape

Legal and General Group is amongst the top key players in the global income protection insurance market. The firm focuses on customized insurance policies. In May 2019, Legal and General Group revised its income protection insurance policies that included increase of overall benefits, removal of drug and alcohol exclusions and launching a new scheme focusing of NHS workers.

Get Complete Report in your Inbox within 24 hours at 3,350 USD

https://www.qyresearch.com/settlement/pre/394d3b56455b157602ce45752a067771,0,1,Global-Income-Protection-Insurance-Market-Report-History-and-Forecast

Other key players include Aviva, Fidelity Life, Royal London Vitality Life, Generali, Allianz, AXA, LV (Liverpool Victoria) and AIG life.

About QY Research

QY Research is a leading global market research and consulting company. Established in 2007 in Beijing, China, QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and custom research to help our clients in providing non-linear revenue models and make them successful. We are globally recognized for our expansive portfolio of services.